Real estate prices analysed at forum

By Alan Markoff

28 Jun 2021

All the speakers at the 2021 Royal Institute of Chartered Surveyors Cayman Real Estate Forum on 28 May at the Grand Cayman Marriott Beach Resort agreed on one thing: Property prices have gone up.

The event brought together professionals in all aspects of the Cayman real estate and development sector.

In addition to discussing real estate market trends over the past two years, the speakers touched on the market impact of the COVID-19 pandemic and how a slowdown during its early stages here was quickly replaced by record-setting levels of sales.

Charterland's Simon Watson shared statistics indicating that the increase in price in the Cayman Islands began in 2015 and was a consistent trend in properties along the Seven Mile Beach corridor as well as elsewhere on Grand Cayman. He said that sales at Discovery Point Club have seen a 169% increase in average sales price since 2015, while on the higher end of the Seven Mile Beach condominium spectrum, The Pinnacle has experienced a 56% increase in average sales price since 2015.

The price increase isn't limited to condominiums on Seven Mile Beach. Watson said the average sales price of a house in Snug Harbour, for example, has increased 70% since 2015 and the inland George Town condominium developments Garden/Coco/Mystic/ Sunset Retreat have seen average sales prices increase 57% since 2015.

Raw land has also seen a big jump in average price, Watson said, giving two examples: Grand Harbour has seen a 53% increase since 2015 and Crystal Harbour a 57% increase in the same time period.

Longer term

Later, Matthew O'Keeffe, the Senior Real Estate and GIS Analyst in Dart's investment analysis team, looked at the Cayman Islands real estate market over a longer term. He pointed out that simply looking at average prices in the residential market does not tell the whole story because of the product quality mix — the same condominiums do not sell every year and the units that do are often in different neighbourhoods, different sizes, different ages and boast different views.

Using a repeat sales index that compares two sales of the same property at two different moments in time allows for an apples-to-apples comparison.

"Broadly speaking, Seven Mile Beach values have grown by a factor of four since 1997 – 6.4% every year," O'Keeffe said. "In Grand Cayman as a whole, condo prices have grown by about 116% over the same period, roughly 3.5% every year."

Why?

Dart's Lou Dimitrov, a real estate economist on Dart's investment analysis team, looked at reasons why Cayman's real estate prices have risen so steeply in recent years and continued to do so during the COVID-19 pandemic.

He noted that before the onset of the pandemic, prices were already going up.

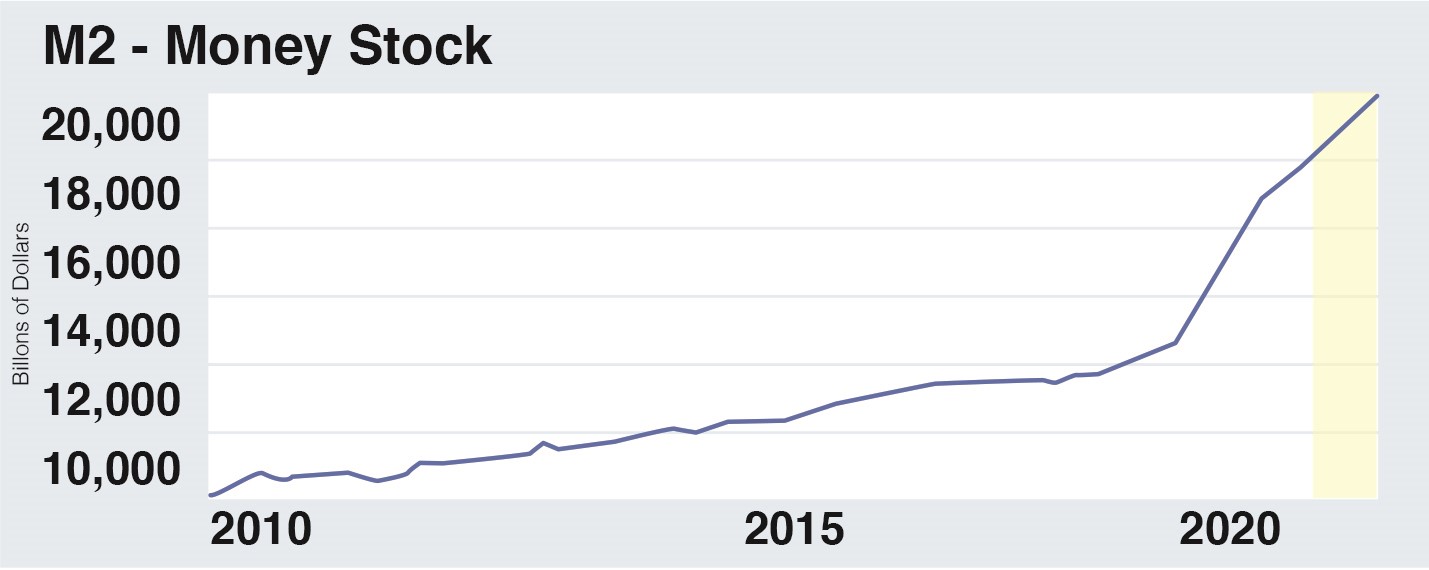

"One of the key reasons why this happened is the expansionary policy of the [United States Federal] Reserve," he said, noting that the money supply has increased and sped up since 2008.

"As a result, asset prices went up," he said. "If the Fed had given the money to young families with newborn kids, it is likely that prices of strollers would have gone up, but they gave it to banks and investors and asset prices, including real estate, increased."

A second reason why prices increased in Cayman after the global recession was growing demand for housing, Dimitrov said.

"New jobs were created and tourism increased," he said, noting that it typically takes one to three years for new development to catch up with demand. "We think that before 2020, there was a period when the  demand for housing units exceeded the supply of units and prices moved up."

demand for housing units exceeded the supply of units and prices moved up."

That housing demand, however, fell once the COVID-19 pandemic began. As a result, tourists stopped coming to Cayman and tourism employees left the island, leading to a downward shift of the demand curve and falling rental rates. Under normal circumstances, lower rents would have led to lower real estate prices, Dimitrov said, but that didn't happen because of swift and strong actions taken by central bankers and governments, pumping money into the global financial system.

"The impact was huge — something like one-fifth of the existing global money supply was created during the last year or so," he said. "In addition to this, governments took strong fiscal measures, which had a similar effect and as we know from the Great Recession, the typical impact of this is asset prices moving up. And this time, the money did not go just in the hands of banks and investors, but regular people."

Another aspect of the expansionary monetary policy that has played a role in higher demand and thus real estate prices is lower interest rates, which made mortgage payments more affordable, Dimitrov said.

Even though real estate prices should have gone down, the downward shift of the demand curve in the rental market was completely offset by the stronger fiscal and monetary measures, he said.

What will happen in the future is uncertain, particularly because of the additional new construction housing coming on line this year.

"Without an upward shift of the demand curve this naturally results in increased levels of inventory and then actually lower rents and lower prices," Dimitrov said. "However, this was not a normal cyclical recession; it was an unnatural — at least from economic perspective — external event. The likely scenario is that at some point of the future, the borders will reopen, tourists will be back and we will have an upward shift of the demand curve, likely offsetting the impact of increased supply."

This article will appear in the July 2021 print edition of Camana Bay Times with the headline "Real estate prices analysed."

About the author

Alan Markoff has worked with Dart as the editor for Camana Bay Times for four years and has been writing professionally since 1997. Born and raised in Cleveland, Ohio, Alan graduated from the State University of New York at Albany with a degree in English, and first moved to the Cayman Islands in 1982. He has 17 years of experience in the real estate industry and previously worked as a journalist for the Cayman Compass before joining Dart to relaunch the Camana Bay Times monthly newspaper. Alan is passionate about food and wine and he loves to write about both those subjects. He is also the leader of Grand Cayman’s Slow Food Chapter.